About Alpha Signals Trading Strategy

Alpha Signals is a backtested, systematic trading strategy derived from a variety of indicators and put together in a simple green or red signal.

What is an Alpha Signal?

In trading, alpha refers to a metric or indicator used to identify an investment that is likely to outperform the broader market or a benchmark like the S&P 500 index, over a certain period of time.

About the Strategy

The Alpha Signals trading strategy is a rigorous and data-driven approach to systematic trading. Through extensive backtesting, I have identified market conditions that provide a high probability of a profitable trend. The strategy relies primarily on technical analysis and specific market indicators to generate buy and sell signals.

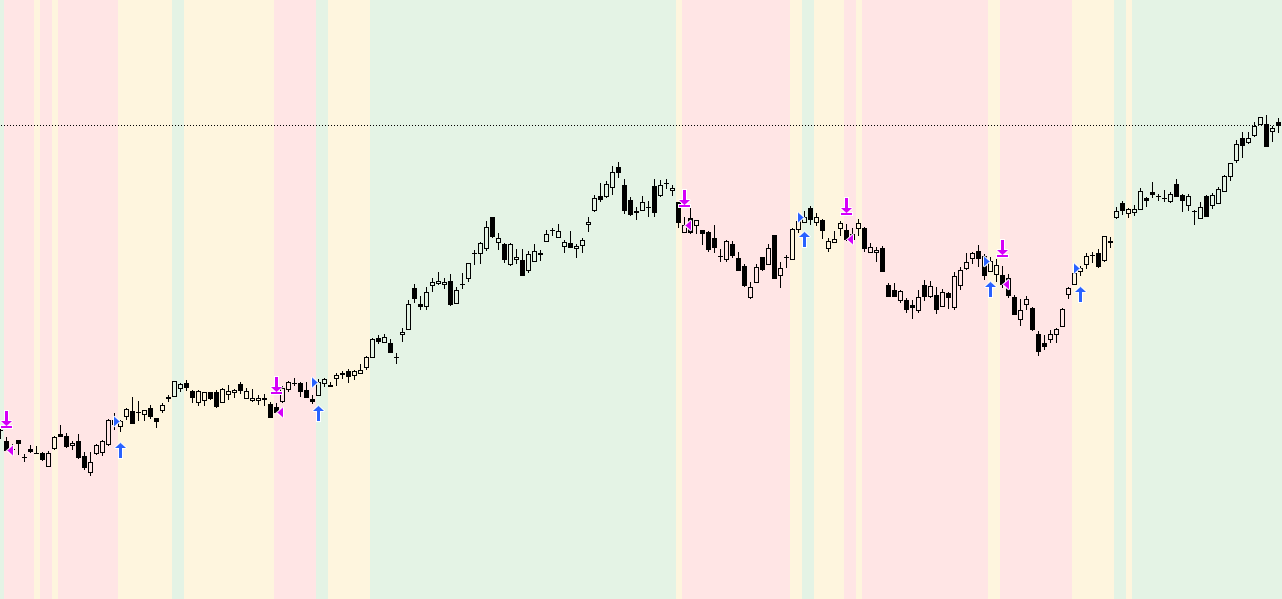

Strategy is derived from a combination of indicators (see below) and put together in a simple green or red signal (indicated by the TQQQ chart background color).

The objective is to minimize number of trades and deploy capital only during confirmed market uptrends, for short to medium-term periods.

Hyper focused and concentrated

The Alpha Signals strategy trades only TQQQ or QQQ ETFs during confirmed and sustainable market uptrends and goes mostly to cash during downtrends or pullbacks (rarely goes short).

Indicators used

Since I'm not a full-time trader that can afford to spend countless hours looking at stock charts and trying to gauge what's the current market conditions (more about situational awareness), I have to rely on a number of indicators that help to understand when to start deploying hard earned capital into the stock market.

Short-term indicator: Net New Highs Crossover (NNHC)

Medium-term indicator: Net New Highs/Lows (NNH/L)

This indicator displays the net number of stocks on the Nasdaq making 52-week highs or lows. It is particularly useful in gauging what the breadth is of the NASDAQ. Three days of net 52-week highs show a healthy market which is conducive to increasing exposure.

Long-term indicator: McClellan Summation Index (MSI)

The McClellan Summation Index (MSI) is a long-term version of the McClellan Oscillator, which is a market breadth indicator based on stock advances and declines. Interpretation is similar to that of the McClellan Oscillator, except that it is more suited to intermediate to major trends and related reversals. The McClellan Summation Index can be calculated as the sum of all the daily values of the McClellan Oscillator. This is used along with the 10-ema to watch for a crossover indicating the beginning of an uptrend or downtrend.

Backtesting

Strategy has been backtested yielding a 3.940% performance!

Most recent alpha signal since November 7th https://www.tradingview.com/x/YZFGtRpY/

An example of the timely sell and subsequent buy signal was seen during the COVID crash in 2020.

Strategy gave a sell signal on Feb 24th 2020 effectively helping to sidestep the profound decline which would erase gains from previous months.

A buy signal was issued on April 9th allowing to harvest a 159% of profits in the following bull run until the end of summer in 2020.

Disclaimer: Investing in financial markets involves risk, and past performance is not indicative of future results. Users should carefully consider their financial situation and risk tolerance before engaging in any trading activities. The information provided on this website is for educational and informational purposes only and should not be considered as financial advice. Users are encouraged to consult with a qualified financial advisor and conduct their own research before making any investment decisions. The trading of stocks, cryptocurrencies, or any other financial instruments carries inherent risks, and users should be aware of the potential for both gains and losses. The website and its content creators are not responsible for any financial decisions made based on the information provided.