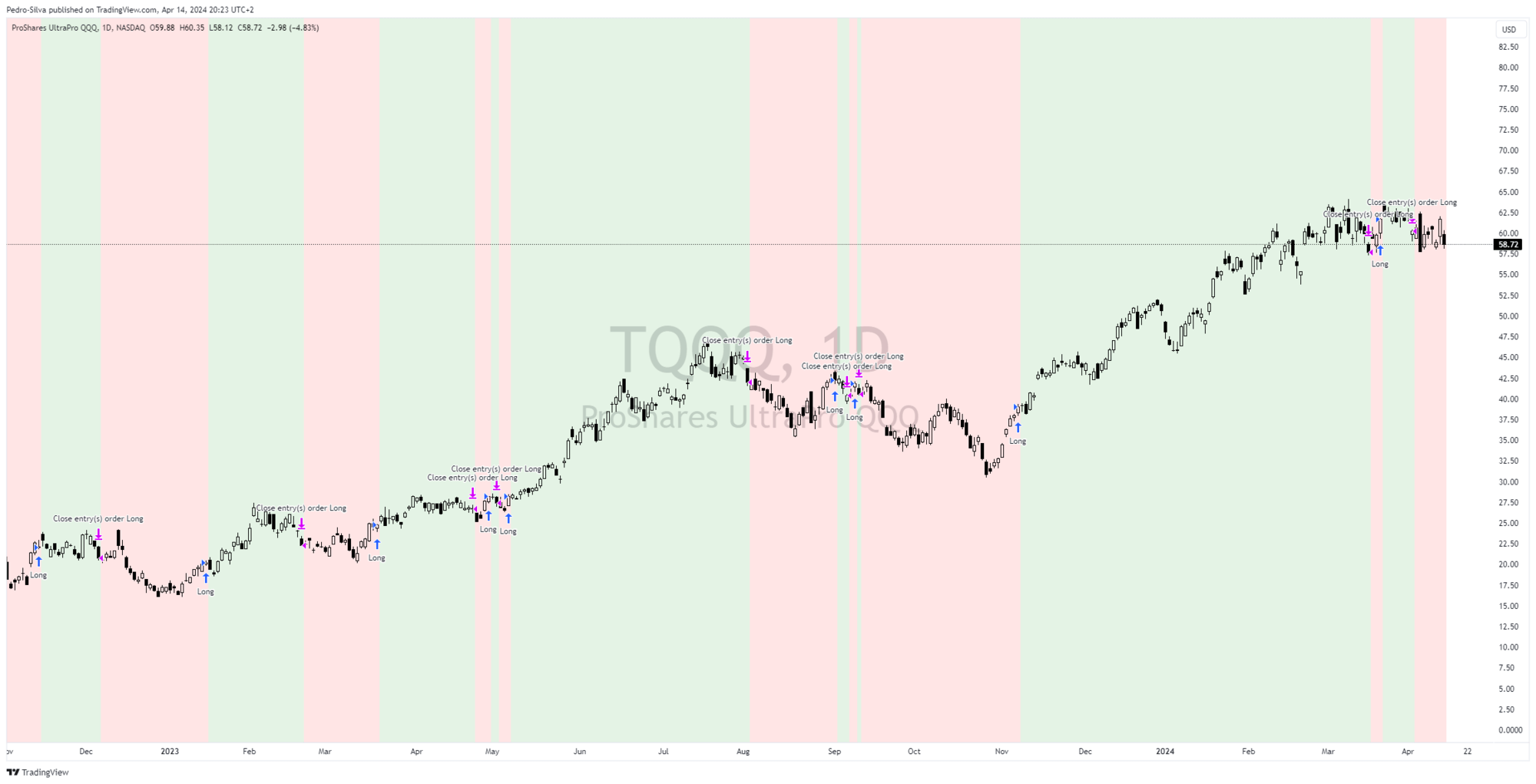

Strategy Update (2024-04-14)

Market continues to chop around within a widening range while looking for direction, no change on strategy which remains on a red signal.

The stock market is experiencing increased volatility, which is typical during turning points. The S&P 500 (SPY) has been testing its rising 20-day moving average and bouncing back to new highs, indicating a strong uptrend. However, last week, it tested its 50-day moving average for the first time in a while, and its future direction remains uncertain. It could either hold and build a new base, signaling strength, or continue lower and test its year-to-date volume-weighted average price (VWAP) near 500.

The technology sector, particularly mega-cap stocks, is holding up better than the rest of the market. This is due to corporations successfully increasing prices while managing costs, leading to improved profit margins. The Nasdaq 100 (QQQ) held above its 50-day moving average, but a loss of the 436 level could lead to a deeper pullback near 430. While NVDA is pulling back, other leaders like Apple are showing strength which is good news.

The market's rise over the past 5-6 months has been based on the premise that the Fed is likely done raising rates and will soon begin cutting. However, recent CPI reports have consistently come in above estimates, and commodity prices have been rising. The current market trend suggests that investors are taking advantage of price dips, and this behavior is likely to persist unless the Federal Reserve unexpectedly shifts its stance and decides to increase interest rates. While this scenario is improbable, it cannot be entirely ruled out. If the Fed changes its message and raises rates, it could alter the current narrative and lead to a more significant pullback. In the meantime, 5-10% pullbacks are normal, but individual stocks may experience more substantial corrections. Investors should remain cautious and wait for the right time to increase their market exposure to navigate the current directionless market conditions.