Strategy Update (2024-04-07)

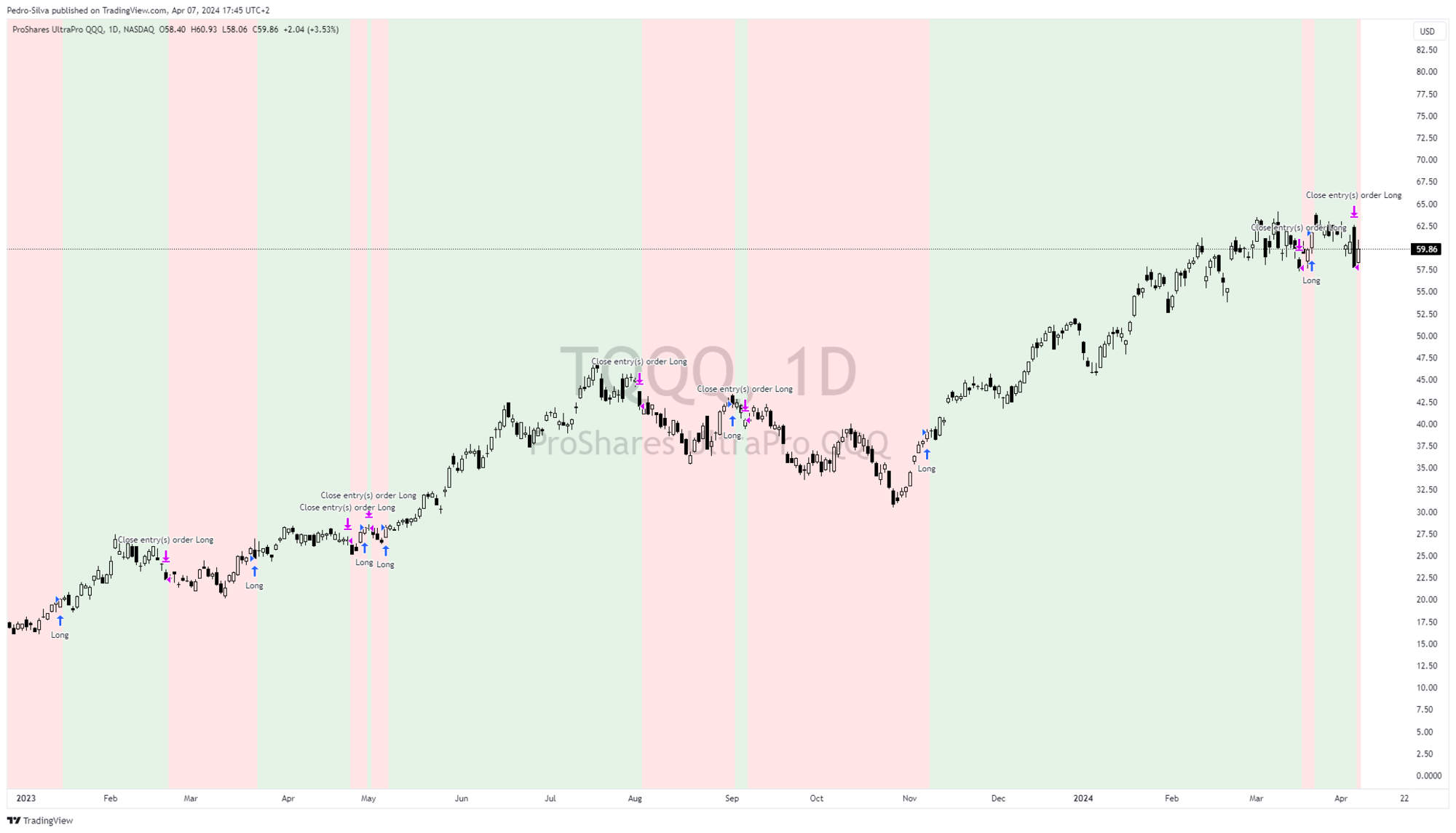

Staying on the sidelines during a choppy environment, strategy gets back to a red signal on April 4th.

After a few weeks of choppiness and increased volatility, the strategy gets back to a red signal on April 4th.

I say gets back because there was a brief period, between March 20th and April 3rd when the strategy was actually green.

I didn't trade and didn't post about these signals due to volatility picking up and the indexes coming under pressure.

I have posted before about the wisdom of patience and resisting the urge to overtrade to achieve long-term success in the stock market.

Remaining on the sidelines during this period of increased volatility saved us from a -6% pullback.

It could be that the ominous sell-off across the board on April 4th marked a short-term low, but we will see day by day.

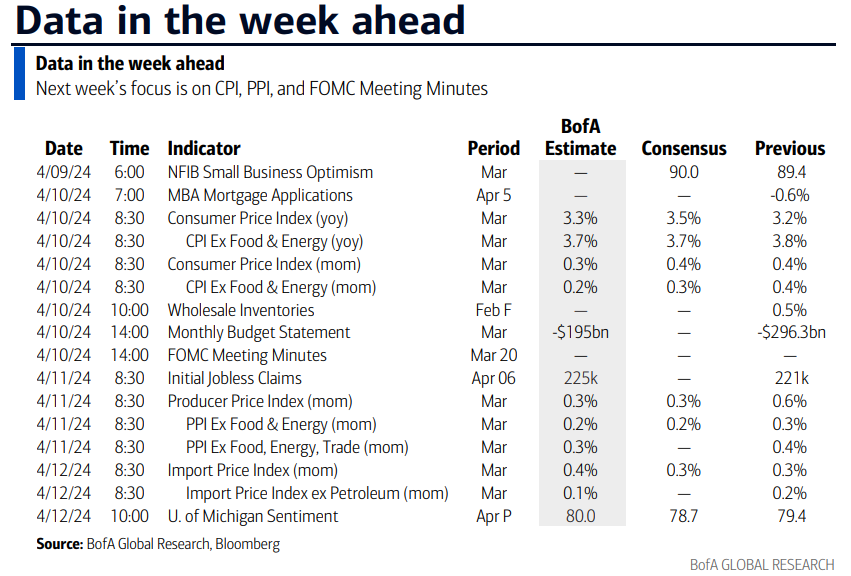

The week ahead

With CPI, PPI, FOMC meeting minutes, plenty of FED speaking and big bank earnings starting, next week will likely continue to be a news-driven market.

While it looks like the long term trend is still up, a short term pullback of 4-7% and even up to 10-12% would not be abnormal. In the meantime, we continue to manage risk in real-time and monitor the strategy for updates.