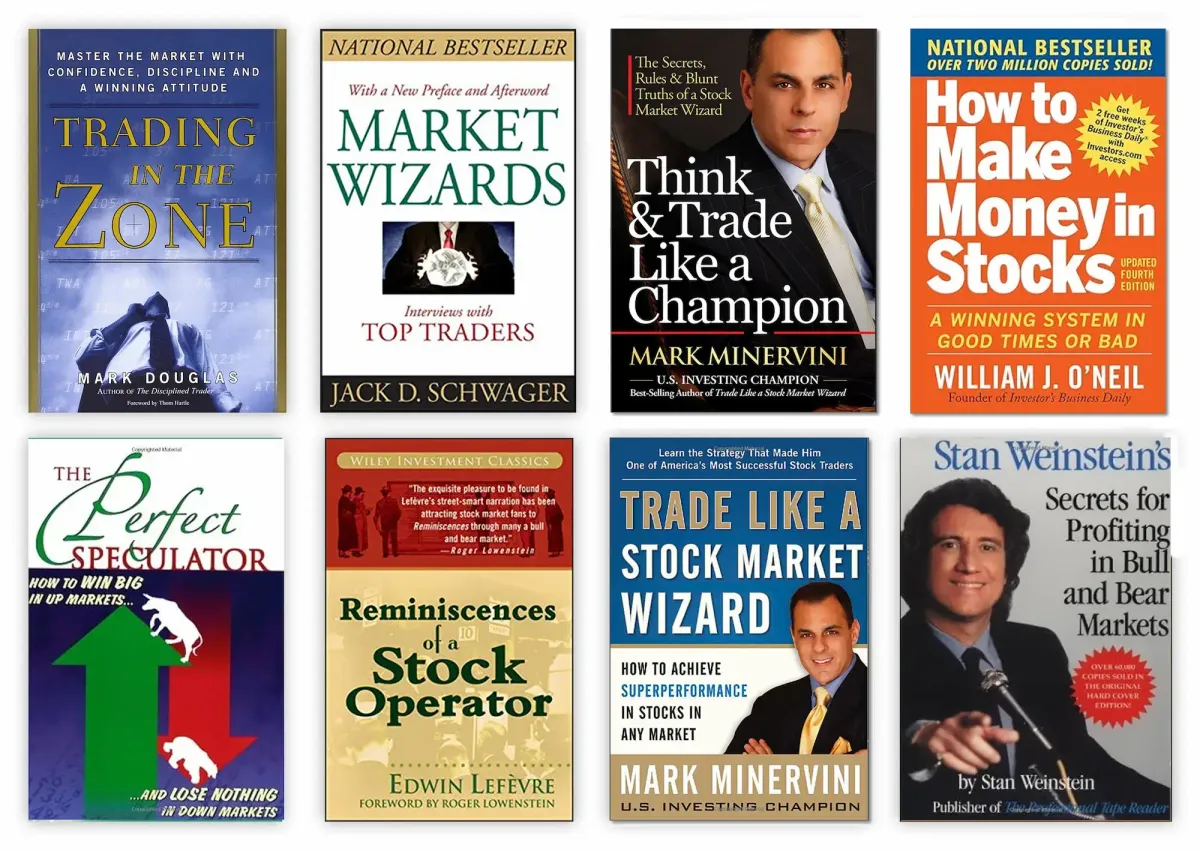

Recommended Reading Trading Books

A personal, curated list of books for traders I recommend reading to learn more about risk management and trading strategies.

There are many books that traders find valuable for gaining insights into the financial markets, developing trading strategies, and improving their overall understanding of trading. Here's my curated list of some of the most important books for traders:

"Reminiscences of a Stock Operator" by Edwin Lefèvre

"Reminiscences of a Stock Operator" is a classic financial book written by Edwin Lefèvre, published in 1923. It's a fictionalized biography that chronicles the life of Jesse Livermore, a legendary speculator from the early 20th century and one of the greatest stock traders of all time. The book offers valuable insights into the world of stock trading and investing. Livermore's experiences, successes, and failures serve as lessons for traders and investors alike. The book emphasizes the importance of psychology and emotions in trading, risk management, and the art of speculation. It remains a timeless and relevant resource for anyone interested in financial markets and the art of stock speculation.

How to Make Money in Stocks, by William J. O'Neil

"How to Make Money in Stocks" is a popular investment guide written by William J. O'Neil. The book provides a comprehensive strategy for successful stock market investing based on the author's own experiences and the study of historical market trends. O'Neil emphasizes the importance of technical analysis and charts to identify promising stocks.

The key principles outlined in the book include the use of fundamental and technical analysis, with a focus on identifying stocks with strong earnings growth potential. O'Neil introduces the concept of "CAN SLIM," an acronym representing key factors such as current earnings, annual earnings, new products or services, supply and demand dynamics, leader or laggard status, institutional sponsorship, and market direction. The author also emphasizes the importance of cutting losses quickly and letting profits run.

Throughout the book, O'Neil illustrates his points with real-life examples and case studies, providing practical insights into successful stock market investing. The book caters to both novice and experienced investors, offering a systematic approach to stock selection and portfolio management. Overall, "How to Make Money in Stocks" serves as a valuable guide for those looking to navigate the complexities of the stock market and improve their chances of making profitable investment decisions.

Stage Analysis, by Stan Weinstein

"Stage Analysis" is a book that delves into the concept of stage analysis, primarily in the context of stock trading and investment. The book provides readers with a comprehensive understanding of how to analyze and interpret various stages in the stock market cycle. Here's a summary of its key points:

Market Stages: The book outlines different stages that the stock market goes through, such as accumulation, uptrend, distribution, and downtrend. It explains how to identify these stages and their significance for investors.

Charts and Technical Analysis: "Stage Analysis" emphasizes the use of technical analysis tools, including charts, patterns, and indicators, to identify trends and confirm the current stage of the market.

Risk Management: The book highlights the importance of risk management in trading and investing. It provides strategies for protecting investments during market downturns and maximizing gains during uptrends.

Practical Examples: Readers are presented with real-world examples and case studies to illustrate how stage analysis can be applied to actual trading and investment decisions.

Psychology of Trading: The book touches upon the psychological aspect of trading and how emotions can impact decision-making. It offers insights into maintaining discipline and emotional control in the face of market volatility.

Long-Term Perspective: "Stage Analysis" encourages a long-term perspective in investing, focusing on wealth preservation and capital growth over time.

Market Timing: It discusses the concept of market timing and how stage analysis can help investors make informed decisions about when to buy, hold, or sell stocks.

Advanced Strategies: For more experienced traders, the book explores advanced strategies and techniques for optimizing stage analysis in their trading approach.

Overall, "Stage Analysis" is a guide that equips traders and investors with the knowledge and tools to better understand the dynamics of the stock market and make more informed decisions based on the stages of the market cycle. It emphasizes the importance of disciplined analysis and risk management for achieving long-term financial success.

"Trading in the Zone", by Mark Douglas

"Trading in the Zone" is a book written by Mark Douglas that explores the psychological aspects of trading in financial markets. The book focuses on the idea that successful trading is not just about strategies and technical analysis but also about mastering the trader's mindset. Here's a summary:

In "Trading in the Zone," Mark Douglas delves into the mental and emotional challenges that traders face and how these factors can significantly impact their success. The book emphasizes several key points:

The Psychology of Trading: Douglas argues that the most crucial element of trading is the psychology of the trader. He explores how emotions like fear, greed, and overconfidence can lead to poor decision-making and trading losses.

Trading as a Probability Game: The author emphasizes that trading is inherently uncertain and that traders should view it as a probability game. It's about managing risk and being comfortable with uncertainty rather than seeking certainty in every trade.

Discipline and Consistency: Douglas stresses the importance of discipline and consistency in trading. Traders need a well-defined trading plan and the ability to stick to it, even when emotions are running high.

Trading Beliefs: The book explores how a trader's beliefs and mindset can shape their trading outcomes. It encourages traders to identify and change limiting beliefs that may be hindering their success.

The Zone: The title of the book refers to a mental state where traders are completely focused and free from emotional interference. Douglas discusses how to achieve and maintain this state for optimal trading performance.

Risk Management: Effective risk management is a core theme. The author explains how traders should determine their risk tolerance, position sizing, and risk-reward ratios to protect their capital.

Market Analysis: While the book primarily deals with the psychological aspects of trading, it also briefly touches on the importance of technical and fundamental analysis.

"Trading in the Zone" is a highly regarded book among traders for its insights into the psychological challenges of trading. It provides valuable strategies and techniques for developing a disciplined and focused trading mindset, which is often the key to long-term success in the financial markets.

"Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market." by Mark Minervini

Mark Minvervini has written many books about trading that can strengthen your understanding of his signature VCP - Volatility Contraction Pattern.

Two of those are "Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market" and "Think & Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard."

In this book "Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market.", Minervini shares his trading strategies and insights that have contributed to his success as a stock trader.

He outlines his SEPA® methodology (Specific Entry Point Analysis) and provides practical guidance on how to identify high-potential stocks and effectively manage trades. The book also emphasizes the importance of discipline, risk management, and a systematic approach to trading.

Remember that trading and investing involve risks, and it's crucial to do your own research and consider your risk tolerance before implementing any strategies mentioned in these books.